Contact Sales at Sunceter.

The 16% tax rate is reduced to 13%, and the 10% tax rate is reduced to 9%, which increases tax credits for production and life service industries!

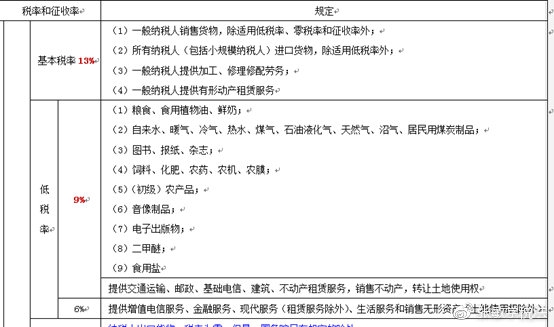

Good news came from the Prime Minister’s government work report: “Implementing larger-scale tax cuts, inclusive tax cuts and structural tax cuts, focusing on reducing the tax burden on manufacturing and small and micro enterprises. Deepening the VAT reform, The current 16% tax rate for the manufacturing industry and other industries will be reduced to 13%, and the current 10% tax rate for the transportation industry and construction industry will be reduced to 9%, ensuring a significant reduction in the tax burden of major industries; maintaining a 6% tax rate is not Change, but by adopting complementary measures such as increasing tax deductions for production and life service industries, to ensure that all industries have only reduced their tax burdens, and continue to move toward the third-grade and two-speed tax rate and the simplified tax system."

The adjustment will not only involve the reduction of the tax rate, but also the scope of the deduction of the VAT input tax will be further expanded:

First, the tax reduction rate

In this adjustment, the third-rate VAT rate has not changed for the time being, but the first two tax rates have been reduced to varying degrees:

Second, expand the scope

In order to ensure that the tax burden of all industries is only reduced, it is proposed to increase the scope of tax deduction for production and living services.

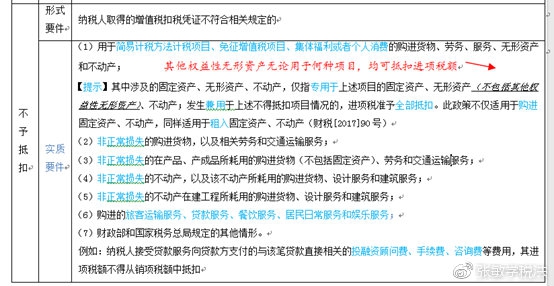

This news will give people more room for delusion as the tax rate will be lowered. The current VAT mainly adopts the purchase tax deduction method, but many purchase service input taxes cannot be deducted. As shown below:

The “increasing the scope of tax deduction for production and living service industries” is estimated to be adjusted from the above-mentioned non-deductible scope. The most likely adjustments may start from the following perspectives:

(1) Input tax for abnormal losses may be deductible.

(2) The input tax amount of collective welfare may be allowed to deduct.

(3) The input tax for the purchase of loan services may be deductible.

(4) Increase the scope of the difference tax payment. Give a further differential tax policy for production and living services.

Of course, all the specific policies have not yet been introduced, and we will closely follow the possible subsequent adjustments.

Copyright © 2025 Dongguan Suncenter Fluid Control Equipment Co., Ltd. | All Rights Reserved

We are here to help you! If you close the chatbox, you will automatically receive a response from us via email. Please be sure to leave your contact details so that we can better assist